The Nifty 50 index ended the day in red, falling by 143 points to close at 24,968. While the Sensex slipped 501 points & settled at 81,757 end of the day. There has been a decline of more than 100 points for 2 consecutive days.

On the last day of the week, Friday, the Indian stock market started trading with a negative sign. Today Sensex opened at 82,193.62 points, down 65.62 points (0.08%). Similarly Nifty 50 index also opened today with a marginal loss of 2.90 points (0.01%) at 25,108.55 points. The market closed with a loss once again after two days of gains. Yesterday the Sensex closed at 82,259.24 points with a loss of 375.24 points and the Nifty closed at 25,111.45 points with a loss of 100.60 points (0.40%).

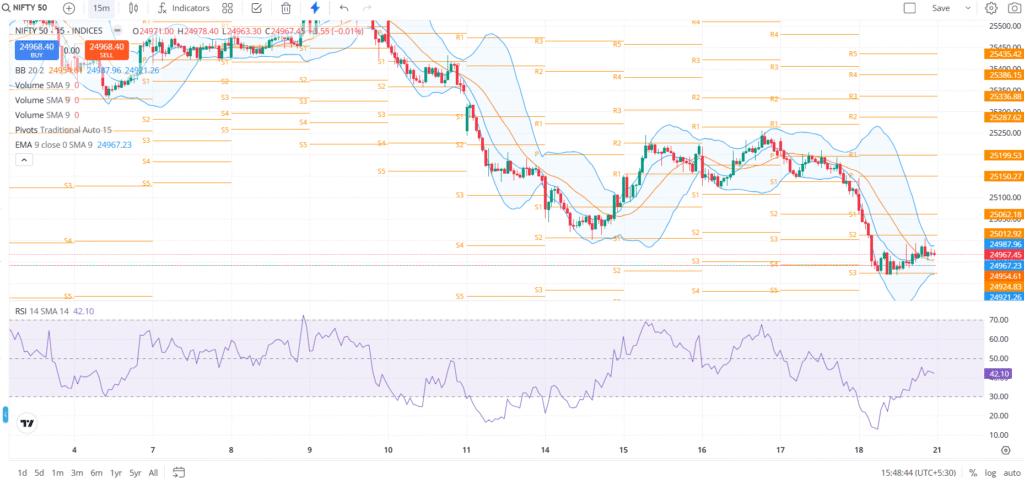

Next Move of Nifty 50 as per technical analysis

According to the price action on Nifty 50 chart, daily candle support is seen around 24,750 to 24,780. And if we look at the support in 15 min candle then it is seen around 24,900 to 24,920. As per Bollinger band indicator this is the place which may be work as support for Nifty 50. But in RSI showing the placement can go down even further, strength is currently in down trend in short term.

Sensex as per technical analysis

Sensex chart showing a support at 81,300 to 81,250 in daily candle price action chart, where if we look at the support in 15 min candle then it is seen around 81,600 to 81,630. As per Bollinger band indicator this is the place which may be work as support . Pivot point standard showing the support 3 of Sensex in 15 min candles is around 81,500.

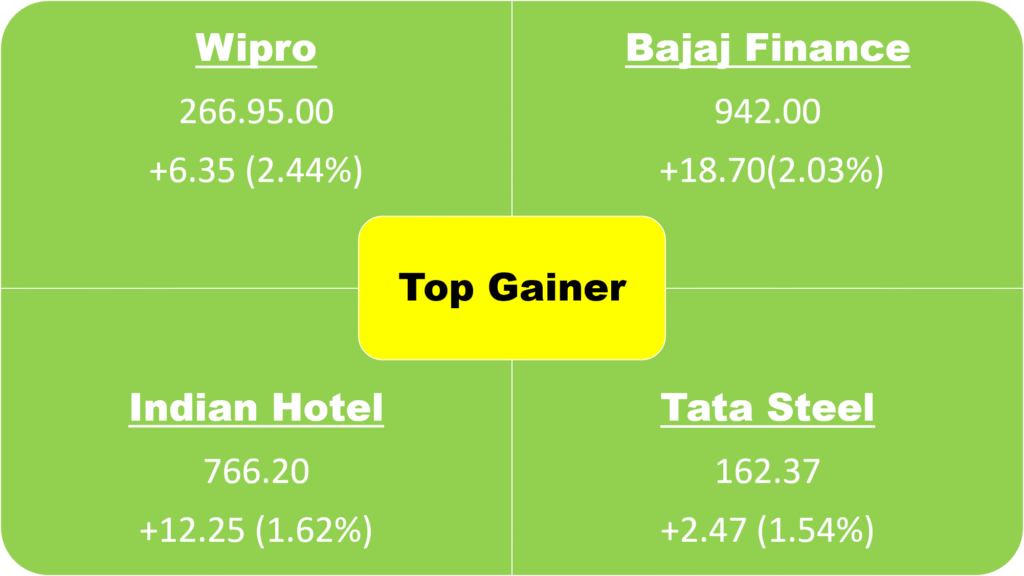

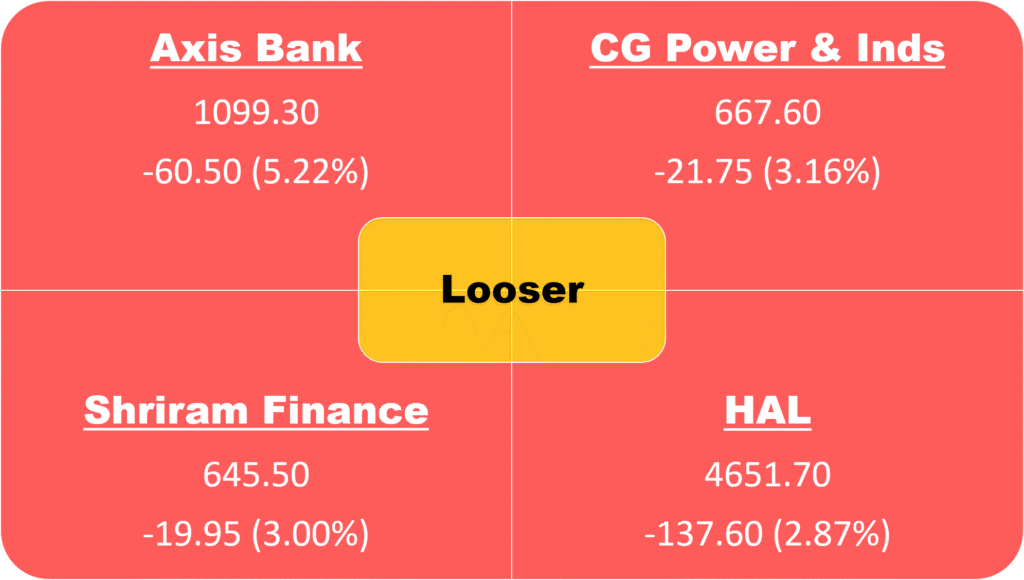

Top gainer & top looser stocks of Large cap on friday market

Today Nifty broke the important level of 25,000. Axis Bank results have weighed on the sentiment. FIIs’ selling is continue it also troubling for short term market. Now the entire focus is on banking sector. Sensex and Bank Nifty also below very important support levels.

Axis Bank reported a strong operating profit of ₹11,515 crores for Q1 FY26, reflecting a 14% year-on-year (YoY) growth. The core operating profit stood at ₹10,095 crores, registering a 5% YoY increase. But the investors are still sell there stocks.

For more blog about share market related : https://utkal360.com/category/stock-market/