Mukesh Ambani’s Reliance Industries has posted a gargantuan performance in the first quarter of FY26. Net profit rising 78% to ₹26,994 crore. This performance is better than analysts’ expectations.

Jio added 9.9 million subscribers & crossed 212 million 5G users. Retail revenue rose 11.3% YoY to ₹84,171 crore with Jio Mart daily orders up 175% YoY. JioStar delivered a record-breaking IPL and revenue of ₹9,904 crore.

Reliance Industries Q1 Results Updates

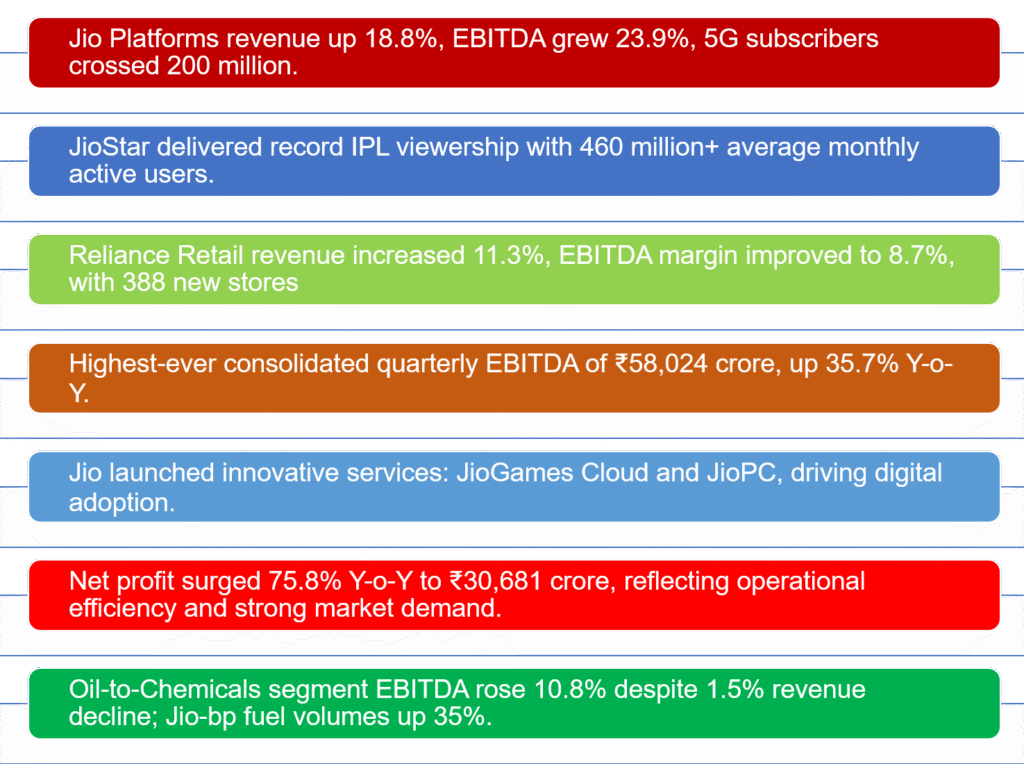

Reliance Industries Limited (RIL) reported huge consolidated financial results for the quarter ended. Company demonstrated strong growth across its major businesses Jio Platforms, Reliance Retail Ventures, Oil-to-Chemicals (O2C), Oil & Gas, and Digital Entertainment (JioStar). Key milestones include Jio surpassing 200 million 5G subscribers and 20 million home broadband connections, significant expansion of retail footprint. Despite global macroeconomic volatility and softer crude prices, RIL’s diversified portfolio enabled a 35.7% year-on-year EBITDA increase to ₹58,024 crore ($6.8 billion) and a 75.8% surge in net profit after tax to ₹30,681 crore ($3.6 billion). The company continued investing aggressively in stock market with ₹29,875 crore in capex during the quarter.

Highlights

Conclusion

Reliance Industries’ Q1 FY26 results illustrate the company’s strategic agility and execution excellence amid a complex macro environment. The digital business’s rapid subscriber growth and innovation pipeline, especially in 5G and fixed broadband. Jio India’s digital economy and user fav. Reliance Retail’s approach and diversification into grocery, fashion and consumer electronics. The O2C segment’s focus on domestic fuel retail and downstream product optimization helps mitigate crude price volatility. The Oil & Gas exploration business is navigating natural resource maturity with planned operational maintenance.

JioStar’s record-breaking digital broadcast performance, Sports potential in India’s and entertainment sectors, exclusive content rights and deepening user through OTT platforms.

RIL’s robust EBITDA and profit margins, low net debt ratio, and substantial cash reserves provide a strong foundation. The company’s ability to blend traditional energy assets with cutting-edge digital and retail ventures exemplifies its transformation into a diversified conglomerate driving India’s growth story.

This comprehensive performance and strategic positioning affirm Reliance Industries’ confidence in continuing its historic growth trajectory, doubling every 4-5 years by leveraging technology, innovation and market leadership across sectors.

1 thought on “Reliance Industries Q1 Results : Net Profit 26,994 crore.”